Is More Really More? Only You Know

Is More Really More? Only You Know

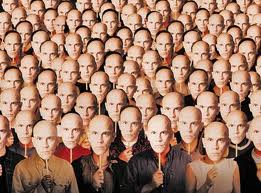

I know brokers who have over 1000 clients and run their businesses like well-oiled factories. Their offices are beehives of activity with secretaries, assistants, and para-planners running around. On the other side of the scale are advisors who have 35 well-healed clients with only one assistant and a low-key office environment. Now there’s nothing wrong with either type of operation. Both are very profitable with happy clients and principals.

Ralph is somewhat introverted. He’s not comfortable in front of groups, hates cold calling, and tends to appear aloof when clients first meet him. But nevertheless, he was able to build his business on referrals from clients who find him trustworthy and knowledgeable.

Ralph provides comprehensive financial planning, analyzes prospectuses, and makes sure his clients understand the advantages and disadvantages of each investment that he suggests. His problem was that he spent so much time with each client that he couldn’t meet with enough new prospects to expand his client base. So he had a choice to make: either hire another assistant or reduce the number of clients but expand the revenue from each one so he could increase his net income.

Diane on the other hand, is a flurry of energy. She frequently gives seminars, attends social functions, and greets everyone with a big smile and handshake. She gives her clients a prospectus, tells them this is what they need, and where to sign. Diane spends as little time as needed with each client so she can run off to the next appointment or seminar. She likes to be on the move and enjoys the diversity of her clients. But how would she find the time get to the next level of production? Like Ralph, Diane had to decide whether to upgrade the value of each client or enlarge the infrastructure of her business to handle additional accounts.

So where does your business fit? And more importantly, where do you want it to fit?

Which Camp Do You Fall In?

Ralph was comfortable with his small office and one assistant. He was willing to modernize his financial planning and investment analyzing software and pay for additional client management training for his assistant. This lead him to the conclusion to only work with clients who were willing to pay for financial planning services and have him manage their accounts for a set fee. Ralph went through each of his client’s files to determine whom he would keep and whom he would terminate.

When he was finished, Ralph ended up with 75 clients in the keep pile and 125 in the terminate stack. This was a difficult chore for Ralph. Many of his “terminate” clients had been with him since he first started, but he knew what he had to do to develop his ideal business.

Based on his typical financial planning and projected advisory fees per client, Ralph estimated that he would need 100 clients by the end of his fifth year in business to meet his income goal. At that time, he plans go through the evaluation process again and expand his practice or set minimum investment or annual fee requirements.

Diane took a different prospective. She didn’t mind working with small accounts and would make the investment to increase her support staff. So she looked at each client file and asked herself, “What are the chances of this client investing more money or providing good referrals?” Those with high possibilities were placed in the keep pile. The ones with minimal chances went to her terminate stack.

Diane’s keep pile totaled 130. She realized that many of those clients only had small IRAs or insurance policies, but they were loyal and made their investments every month without any work on her part. The other 70 got transferred to another local advisor with her broker-dealer. These included many of her struggling baby boomer clients with term policies whom she had to call every month to follow-up on their premium payments. And as far as any potential referrals were concerned, she decided that she most likely would not want to talk to anyone whom they knew anyway.

With that mind, Diane figured she would need 300 clients by the end of her fifth year to hit her goal. And as long as she could continue her marketing strategies and let assistants do the rest, she was confident that she would be successful.

How Will You Get There?

Don’t be timid about firing clients if you think they won’t be satisfied with your services or who can’t make decisions for themselves. Screen clients and prospects. Do you chase after every $3000 IRA account? It can take just as much work to get a $3000 account as it would to snag a $300,000 one. Sometimes more since the smaller account owner might need a lot more explanation that the larger investor.

Go through your clients’ statements. Use Ralph’s criteria to decide which ones fit your ideal profile. Or like Diane did, evaluate the chances of getting any additional business or good referrals from each account. Set aside time to reflect on what you want your business to look like two years from now. Look objectively at your clients and your goals. Tough decisions today will reap better service for your clients, more referrals, and a higher level of income and career satisfaction for you.