Have you ever had a conversation with a client explaining the devastating effects of inflation and why they need to take action now? Yet the client seemed unaffected because inflation is not a pressing current problem and the idea that their cost of living will double in 23 years, while intellectually understandable, has no emotional urgency.

Have you ever had a conversation with a client explaining the devastating effects of inflation and why they need to take action now? Yet the client seemed unaffected because inflation is not a pressing current problem and the idea that their cost of living will double in 23 years, while intellectually understandable, has no emotional urgency.

This creeping inflation is like the creeping erosion of your business. You won’t get emotionally excited when I explain it, but if you don’t act, like your client who ignores inflation, the erosion will ruin your business.

First, your credibility is shot. Many Americans no longer trust people in the financial services industry because of repeated ethical transgressions. And even though you don’t have anything personally to do with churning, twisting, late trading, insider trading and exorbitant fees, you are part of that “club” by default. More and more Americans are becoming “do-it-yourselfers” because they don’t know who to trust.

Secondly, competition is way up. Fifteen years ago, stockbrokers did not sell insurance products and insurance agents did not sell investments. Fifteen years ago, CPAs were not expanding their business into financial planning and financial product sales. Fifteen years ago, there were not 18,000 registered reps and 4,300 insurance agents working in banks.

Third, the “compression evolution” of every industry also affects the delivery of financial products and services. This compression is when the middle man, you, gets pushed out. You’ve seen it in hardware stores. The corner hardware store got pushed out as the warehouse distributor decided to sell direct to the public (Home Depot, Lowes). Your family doctor, once an independent business person is gone. He is now an employee of an HMO. In every industry, the number of people involved in the delivery of any product or service shrinks as technology improves. Last year 11% of term insurance was sold on the Internet. The largest fund families, Fidelity and Vanguard, get most of their assets by dealing directly with the public. Any advisor that uses Schwab to hold their client accounts will tell you that Schwab keeps expanding their services with the goal of dealing directly with the retail clients.

Fourth, the Internet erodes the business of most advisors. Most advisors offer nothing other than information. As little as 15 years ago, if an investor wanted to know how his shares of IBM were doing mid-day, he called up his broker. There was no prolific Internet access. Information was in the hands of the financial advisor. Most advisors still think they add value because they understand how particular products work. The Internet makes information have no value. Therefore, the only advisors that have any defense are those that provide insight, not merely information. For the insurance agent, a huge chunk of term insurance has been swallowed by Internet sites because there is little that the buyer needs from a professional.

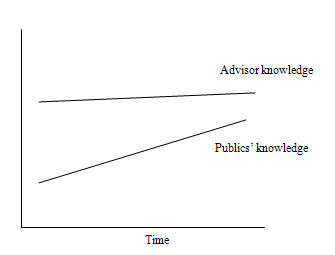

Last, the public keeps getting smarter and therefore, has less need for you. The 60-year-old today knows a lot more about personal financial issues than his dad did at age 60. Prior to 1972, there was no Money Magazine or any financial magazine for the masses. Now there are maybe two dozen with multi-million copy distribution every month. There was no CNBC, Nightly Business Report or Lou Dobbs. These new sources of information combined with the Internet simply make the public more informed and smarter. Here’s what’s happened.

The public is closing the gap between what they understand and what the average advisor understands. The smaller the gap, the less need for an advisor.

What steps can you take?

Get smarter. If you have not completed the CFP® or ChFC program (or the CRFA™ program for advisors serving seniors), then do so. If you don’t raise your knowledge while the public increases their knowledge, your relative value diminishes.

Attend every possible education opportunity you can (NOT product education). For example, life insurance companies regularly hold estate planning seminars. For investment professionals, attend the Financial Advisor Symposium and get recordings of past meetings. Read the articles that populate Morningstaradvisor.com for a better education on funds and read some of the classics like “Stocks for the Long Run,” by Jeremy Siegal, “Winning the Loser’s Game” by Charles Ellis and “What Works on Wall Street” by James O’Shaughnessey.

Read the better publications in the industry—Financial Services Journal; Financial Advisor; Investment Advisor and Financial Planning Magazine for investment professionals, National Underwriter and Advisor Today for Life Insurance professionals. For life insurance professionals, visit MDRT.com and you can order any of the past presentations from the annual MDRT conference.

There are myriad opportunities for education if you are proactive.

Increasing your education and technical competency helps mitigate all of the threats to your business:

• It retains your gap of knowledge over the public

• It allows you to gain and provide insight, not just information (something the Internet cannot do)

• It defends you against compression evolution because only commodity products can be provided by manufacturers directly to the public. Increased knowledge and insight allow you to provide non-commodity services

• You already have a running start over new competition and constant educational advancement will allow you to maintain the lead

If you cavalierly think you don’t need to do any of this, remember, your business erodes imperceptibly. You may not see these eroding issues year by year, but like inflation, the longer term effects are devastating.

[…] It’s also likely that these firms do things that irritate you and your clients or may even lose you clients. Your firm does not do these things intentionally. However, they employ people who don’t […]